This post is sponsored by The Huntington National Bank. Thank you for supporting the brands that support Beginning in the Middle!

Bryan & I are really excited to work with our bank, The Huntington National Bank, to open up the discussion about money and share more about our personal experience with it. Figuring out how to make it, grow it, spend it, and avoid losing it are just a few of the things we’ve been all too familiar with since we began our journey to financial freedom five years ago… and I have a hunch we’re not alone! Over the course of the year as Huntington ambassadors, we’ll be sharing more about different money-related topics that are meaningful to us. Our hope is that by doing so, we can inspire & help you achieve your own money goals, whatever they may look like.

how did we get started?

You may have heard us talk about real estate investment, becoming vacation rental hosts & launching our own brand, starting our interior design studio, and quitting our day jobs to become entrepreneurs. One of the questions we get asked most frequently is how we got started, and the answer is much less glamorous than you might think. All of it began with us getting super clear on our finances one night almost six years ago, making a big mindset shift, and taking action.

Less than a year after we moved from NY to Columbus, I had a big health scare that turned our lives upside down & encouraged us to reevaluate our lifestyle. We made changes by eating healthier and exercising, but the biggest change we made had to do with money. Up until that point, we admittedly didn’t pay much attention to it. We knew we were making it and spending it, but didn’t know where it went. We knew we had debt, but didn’t know how much. We didn’t have a budget, we didn’t track any of our expenses, and we didn’t have any concrete money goals. (Has anyone else been here? Just us?)

We sat down at the dining room table one night and started writing a list of all of our income, expenses, debt, and assets, one by one, until we had everything accounted for. When we added up all of our debt, we were shocked at what we saw:

Student loans: $140,205

Credit cards / loans: $16,405

Car loan: $8,100

Total: $164,710

Those debt balances translated to payments of $3k+ per month, and that didn’t include any other living expenses like our mortgage or food or utilities. We did more analysis and realized that we had a negative net worth, that our student loan payments alone were more than our mortgage payment, and that thousands of dollars were going toward interest each year on things that had no return on investment.

making a change

After reading some personal finance books & very inspiring early retirement blogs, we got on a budget and started focusing on paying off our debt. At the time, none of that debt was income producing (except for maaaybe some of my student loans leading to my job, if we want to make that argument — it’s a stretch ;)) so we were essentially paying a lot more for our purchases than we realized. Seeing these numbers on paper in tangible form was incredibly motivating and made us super excited to get rid of it. We felt like we had a big challenge ahead of us, but we also knew that having an extra $3k each month in our pockets would have a huge impact on our quality of life.

Bryan & I both still had our full-time jobs at the time (he was in construction and I was a tax consultant) but wanted to see if we could make more to speed up the process. We considered delivering pizzas and getting a roommate or two, but then got an idea. We had just purchased a 3 bedroom home that we were decorating… what if we leveraged the work we had done on that home to make the extra money we needed? Increasing our income without spending lots of extra hours working sounded like something worth trying. So, we listed one of our spare bedrooms as a short-term rental and waited to see if anyone was interested.

It worked. People were booking, and we were making enough money to pay our mortgage, which was around $1,100 at the time. It continued for a few months before we started getting requests for our whole home, which meant we could make much more but would have to find a place to stay while our house was rented. Family sleepovers and hotel/motel stays were starting to become the [less than ideal] norm, and although we were super motivated by our progress, our situation wasn’t sustainable. We didn’t want to move back into our home and give up the rental income we were earning, so we decided to find somewhere less else to live.

We purchased our first investment property for $59,000 in 2014. It was a duplex in a transitional area with a monthly mortgage payment of around $500 for both sides. Our plan was to live on one side and rent out the other side for $700-900, which would cover the entire mortgage payment for both sides and allow some wiggle room for maintenance, etc. This would allow us to live for free and help us reach our goal even faster.

It wasn’t that easy (is it ever?) and the home ended up needing a full gut remodel on both sides due to a whole host of issues that we didn’t see coming. Our faces in that photo above show just a glimpse of the overwhelm we were feeling at the time! We didn’t have tens of thousands of dollars to put into hiring a contractor, so we started doing work ourselves and quickly realized the value of doing our own labor. Bryan left his job later in 2014 to focus on the renovation full-time, and I helped him after my job and on weekends.

We had the full house completed in 2015, and decided to sell it when we were finished to recoup the money we had invested. We ended up putting about $60k into it (not including our labor) and sold it for $160k. We used the profits to pay down a bit more debt & saved the rest to invest into our next property (because at that point, we were hooked on designing & renovating together!). We kept the ball rolling by purchasing 1-2 properties every year. We mixed flips with rentals — the properties we flipped earned us larger chunks of money to pay down debt & put toward new projects, and our rentals increased our monthly cashflow & net worth.

We worked a TON of hours for a few years straight, lived in major renovations to keep our expenses down, and worked on continuing to increase our income/reduce our debt. It was a lot of sacrifice, but by 2017, we had paid off about 3/4 of our personal debt, which equated to a reduction of about $2,700/month in bills. It felt like we had gotten a huge tax-free raise! That $2,700 reduction in our monthly expenses, in combination with the extra rental income we had built up, made it possible for me to quit my job & join our business full-time.

where we’re at todaY

It’s been a little over two years since we’ve both been working for ourselves full-time, and it has been an exciting roller coaster. Our income is now comprised of a mixture of rental income from our 3 vacation rentals (we’re in the middle of renovating our 4th and recently revealed the kitchen!), brand sponsorships on Instagram & our blog, and our interior design clients. Our personal debt balance is down to $25k (in student loans), and our payment is now about $300 per month. Our net worth is no longer negative, and our new rule on debt is to only take it on if it’s income producing. This means that the money we can make from taking on the debt outweighs the debt itself & gives us a return on our investment. We try to apply that philosophy to most of our purchases, from buying new clothing and new cars to vacations, tools, etc. We’re far from perfect when it comes to sticking to our budget, but we’re continuing to work hard and keep our goal in mind. It’s a balancing act, but we’re moving in the right direction and it feels great!

getting organized w/banking

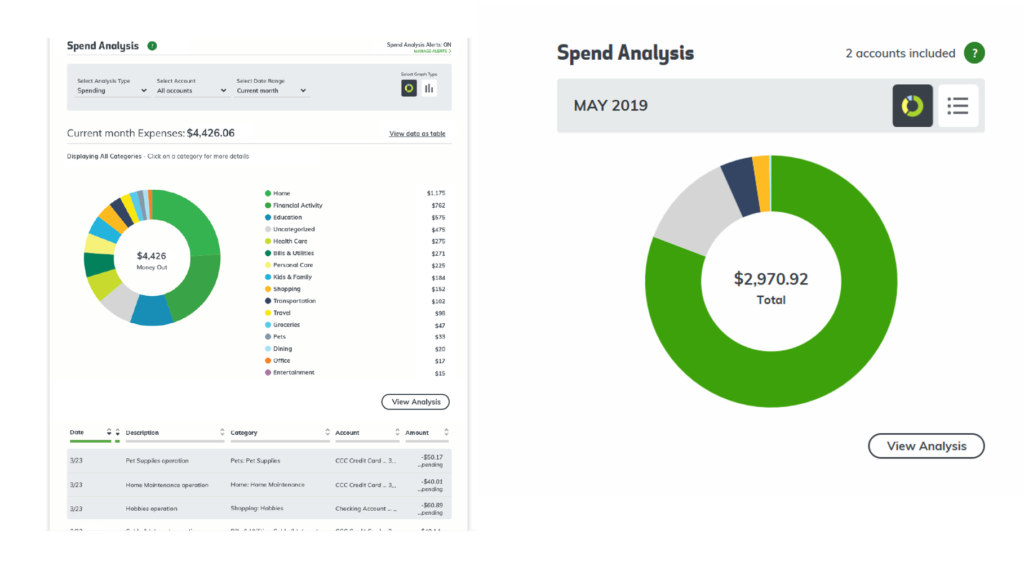

With different forms of income coming in the door, and lots of expenses to keep track of, we have recently been making an effort to get more organized with our banking. We switched to Huntington Bank last year because we loved their user interface & spend analysis features (something that our previous bank did not have). Here’s a snapshot at what the interface looks like (this isn’t ours — it’s just a sample!)

Something that we’re experimenting with this year is having a separate checking account for each of our vacation rentals. We have direct deposit set up on each property, so income is routed to that property-specific account, and expenses, like utilities, are auto-deducted each month. Keeping each rental separate allows us to quickly look at cashflow each month and keep track of how each one is doing individually.

we want to hear from you!

We’ve found it interesting & helpful to hear others’ money stories, and hope that by us sharing more about ours, we can help you, too. If you have a money story to share, we would LOVE to continue the discussion in the comments below. And if you have a specific money-related topic you’d like us to cover in our next post, leave a comment about that, too!

xo,

C&B

I love it when people share the behind-the-scenes decisions that make everything possible. I find real estate fascinating and would love to get more involved, but I always wonder how people get into it who don’t have a ton of money upfront to begin with. Thanks so much for sharing real numbers—so excited for this series!

Thanks Torrie!

This is a great story and I hope it inspires someone who doesn’t keep an eye on their spending because it shows how important it is.

When I was 25, I wasn’t making much, but I wanted to keep track of what I was spending. I joined Mint.com and it was an eye-opener! I became much more vigilant. 10 years later and I also have Quickbooks Self-Employed which helps me track of that side of my life. Between the 2 and my occasional spreadsheets to make sure I understand my monthly budget, I’ve been able to have a nice life without making a ton of money.

The pay off has been that my S.O. and I were able to quit our jobs and travel for a year when we were 32. A year after coming back we were house shopping. All of our home improvements have been paid for in cash (and by that I mean on the credit card for the miles/points then immediately paid off). I have the patience to wait and save up so even though we have made a ton of improvements on our first home, we’re not in any debt for it. I’ll admit that I grew up just above the poverty line so I can tighten my belt by quite a bit without a feeling like I’m sacrificing.

AMAZING story, Emme – so inspiring. We, too, hope to travel a lot once we reach our goal, and love QB Self Employed! Have you heard of Mr. Money Mustache? He’s all about frugal living – but because he’s in his 30s and retired and has a great life, he never feels like he’s “sacrificing” anything.

You guys inspired me to get my finances in order back in the early days when you recommended I read a Dave Ramsey book. I’ve been making sure to keep a good credit score and keeping my debt down as much as possible since!

Yay!! That book really did change the way we think about money. We’re excited for all of the big things you’re doing!

Very inspiring, love that you guys do it together.

Thanks Tania! It helps a lot to hold each other accountable.

Thank you for sharing this! I follow you on Instagram, and I am amazed by the creativity and design of your work. I also love to see your beautiful, growing family!

How would you suggest getting started with income producing properties in Los Angeles? The problem I have is that even the “fixer uppers” are unreasonably expensive and immediately get snatched up by developers. Any tips or insight on this issue would be much appreciated! And keep up the excellent work; your posts truly bring me joy 🙂

Beth

Great read! Your story sounds very similar to my husband & I but we have just entered the world of real estate on our financial independence journey. With over $200k in student loans and additional debt from a car loan, personal loans and cc debt, we decided to sell our home that we purchased in 2017 after rehabbing it. It sold for over 60% of what we purchased it for just two years ago with less than $30 invested. We have the market and neighborhood to thank as well. Although we were hoping to wipe out all of our student loans with the sale, we cleared out our other debts and put a down payment on our first rental property. Now, we are living in a duplex we purchased this Spring, house-hacking our way to our next investment property. It’s great to see all of the wonderful things you are doing in Cbus – keep up the great work!

CMN

How amazing, guys! Thank you for sharing your story. So excited for your progress — you’re on the right track!

[…] We have big business dreams that all require extra capital. Yes, we have investors and can get loans, but it’s important to us that we keep a good balance of cash vs debt for personal purposes, too. Focusing on our personal finances 6 yrs ago is actually what jumpstarted everything we’re doing today, from our Village Host rentals to Beginning in the Middle. More on that story here. […]